Globally, indirect, and direct tax professionals interpret data and derive actionable insights from their interpretations. The guidance they offer stakeholders in real time supports better business decisions.

Thomson Reuters’ Digital Transformation (DX) in Tax Compliance and Statutory Reporting 2023 Survey Report reveals a gap between expectations and reality:

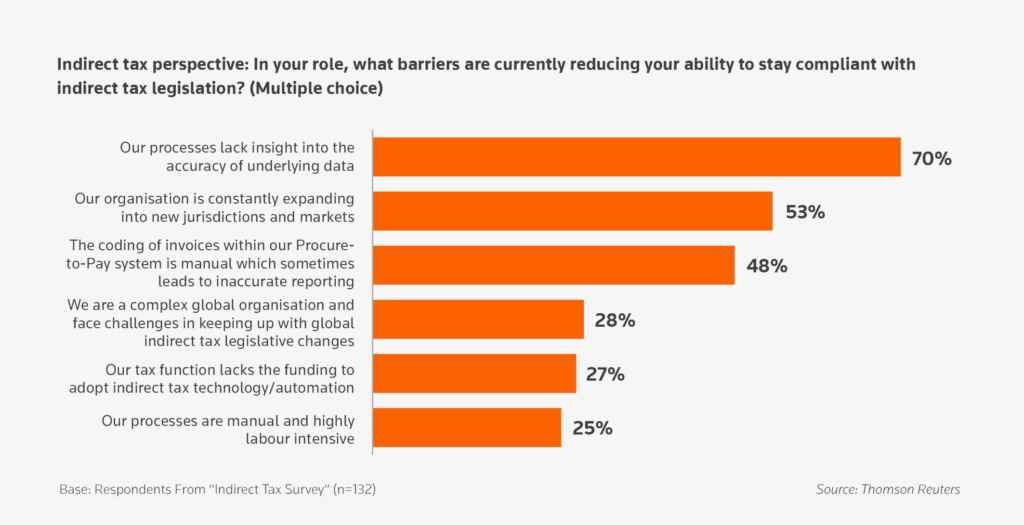

A vast majority of indirect tax compliance professionals surveyed (70%) said their processes lack insight into the accuracy of underlying data.

This underscores two things. One, data inaccuracy and data management is a problem that needs addressing. And two, data precision plays a critical role in the realm of tax compliance.

At the heart of this predicament lies a challenge. How can technology help them reach a desirable level of data insight and accuracy?

Let us delve into why increasing accuracy in tax reporting is a top priority for many professionals in the field. A strategic push towards digital transformation could transform tax compliance and reporting as we know it.

The role of accurate and on-time compliance

Accuracy of underlying data is an area of concern for about every tax professional:

Increasing the accuracy of tax reporting compliance is a top priority for most tax compliance professionals surveyed (73%).

Factual tax reporting is a cornerstone of trust in relationships with government regulators and tax authorities. Internal and external stakeholders view a company’s tax compliance status as reflecting its governance and ethical standards. Therefore, errors have the potential to impact stakeholder relationships and damage reputation.

Moreover, accurate tax reporting aids in better decision making. Reliable data offers insightful metrics to help guide strategic planning and forecasting. Having access to such information enhances operational processes. In turn, these elements contribute to improved financial performance and securing future growth.

Escalation of digital transformation initiatives

The same report that highlighted the primacy of accuracy in tax reporting also revealed the following:

A sizeable proportion of direct and indirect tax influencers (61%) view launching a new digital transformation strategy as a key priority.

This emphasises the growing recognition of the potential for digital technologies to perform tax compliance duties. Again, such an initiative has accuracy and the aspiration to provide real-time data and tax transparency at its core.

Advanced technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and blockchain offer a host of benefits. From automating tax compliance processes to improving tax data quality, these innovations transform routine tasks into meaningful insight.

From e-invoicing, direct and indirect taxes to international taxation, businesses are already leveraging technology to automate repetitive tasks. But there is more to technology than automation. Digital transformation can provide a viable solution to the challenge of unlocking insights from tax data.

The focus on data accuracy in tax compliance

Understanding the intricacies of the tax compliance landscape requires a deep dive into data. And data is key to accuracy and, by extension, compliance with tax legislation.

Without the ability to gather and analyse the accuracy of underlying data, consequences can include:

- Incomplete tax reporting

- Damage to reputation

- Financial penalties for compliance infringements

Tools such as AI and ML can automate data collection while ensuring relevance and quality. Sifting through large volumes of information, smart tax technology mitigates the risks associated with manual processes. This helps tax professionals obtain an accurate view of their company’s tax situation.

A focus on collecting and analysing vast transactional data provides organisations with an accurate understanding of tax compliance laws. As the regulations evolve, leveraging advanced technologies will become increasingly important. Features such as in-built content and data reporting features are key.

Prevailing tech stack is an assortment of disparate systems

The existing tech stack, a medley of Enterprise Resource Planning (ERP) systems, e-invoicing, spreadsheets, and documents, has its limitations. Generic automation tools can manage simple, repetitive tasks. But they may struggle to handle the complexities and nuances of tax regulations across multiple jurisdictions and incorporate local nuances.

Technologies that encapsulate the world of tax and adapt to ever-changing regulatory changes in real time are highly desirable.

It is no wonder that:

Almost half (49%) of the tax compliance professionals surveyed said that using new tax automation software is a top priority.

Optimising your DX strategy: Next steps

Uncover the challenges, solutions, and business process improvement opportunities for corporate professionals. Explore Thomson Reuters’ Digital Transformation in Tax Compliance and Statutory Reporting 2023 Survey Report via Part One: Macro Trends Driving Tech Adoption in Tax and Finance today.